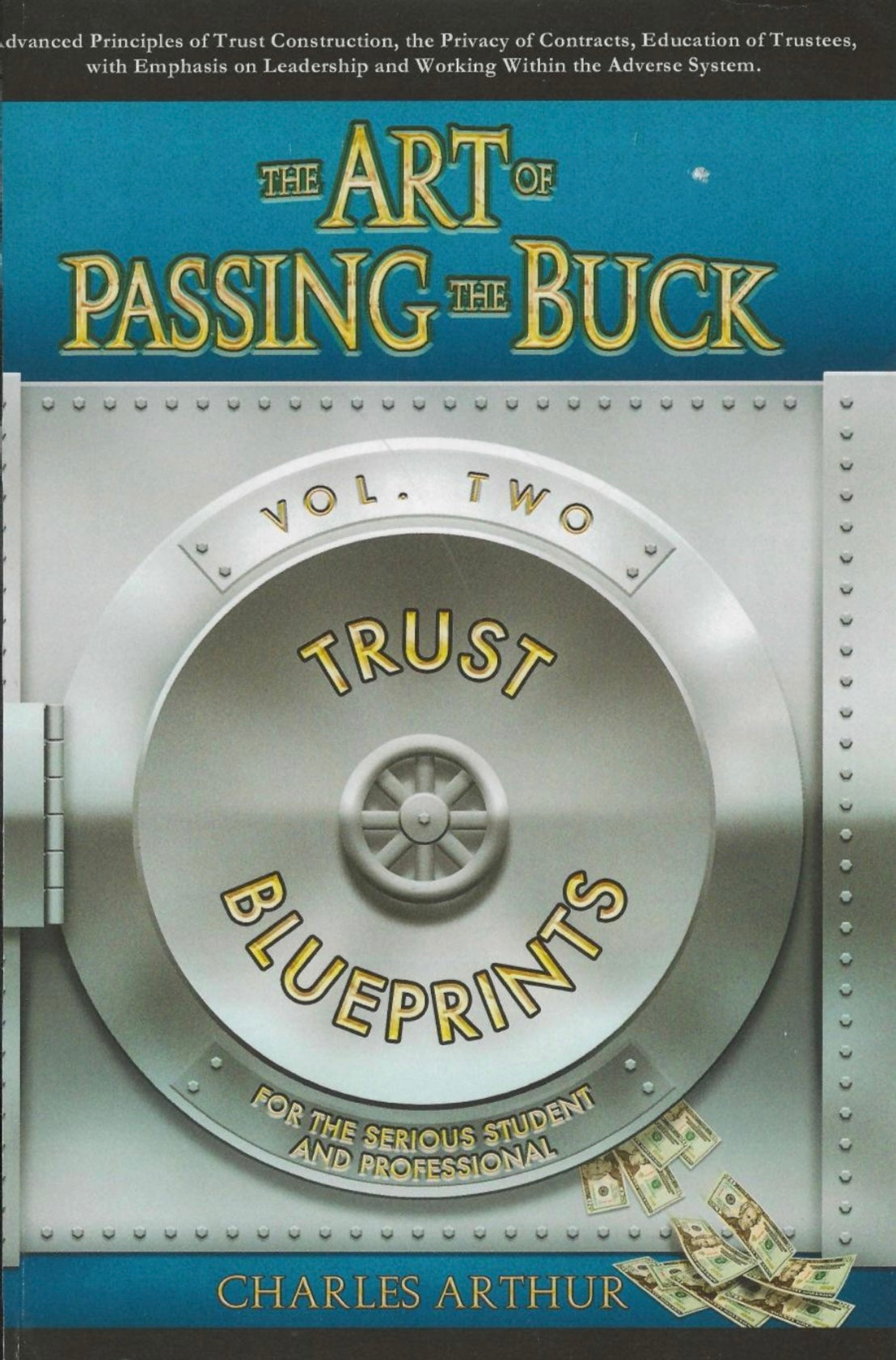

Trust Blueprints E-Book

Trust Blueprints E-Book

Couldn't load pickup availability

1. Asset Protection

Shields personal and business assets from lawsuits, creditors, and liabilities.

Separates ownership from control — the trust owns, you manage.

Protects family wealth across generations.

Can be designed to be “bulletproof” from legal claims if properly structured and compliant.

2. Privacy & Control

Keeps ownership details private (trusts are not public like corporations).

Allows control over how assets are used without them being in your personal name.

Enables private contracts, banking, and holdings outside of public record exposure.

3. Estate & Legacy Planning

Avoids probate (the court process after death).

Ensures smooth transfer of wealth to heirs or beneficiaries.

Can specify long-term instructions — generations into the future.

Reduces estate taxes and delays for beneficiaries.

4. Tax Strategy & Efficiency

Depending on jurisdiction and type, can provide significant tax advantages.

Allows income shifting and timing control.

Enables charitable structures and foundations for legal tax reduction.5. Business &

5. Investment Advantages

Owns companies, real estate, or intellectual property as protective holding entities.

Simplifies partnerships and investor relations through trust-held shares.

Provides legal continuity even after the trustee’s death or replacement.

6. Sovereignty & Legal Structure

Establishes a private legal domain under trust law (separate from statutory law).

Can be structured as a private express trust, contract trust, or irrevocable trust depending on goals.

Defines your own internal law (trust indenture) — the rules of your own jurisdictional microcosm.

7. Spiritual & Legacy Dimension

Embodies divine stewardship — holding assets as sacred trusts.

Allows wealth to serve higher missions, family, or humanitarian aims.

Becomes a living vehicle for your dharma, values, and destiny to continue beyond your lifetime.

Share